The Wall

Street Journal today reports on a J.P.

Morgan Institution study showing that the majority of households experience

regularly significant cash flow variation and monthly shortfalls where they

need access to additional funds. The

summary graphic from the J.P. Morgan Institute below shows their findings on

income volatility and that most individuals do not have a sufficient financial

buffer.

J.P. Morgan Institute Study

This need for transaction liquidity has also been well

documented by the Center

for Financial Services Innovation (CFSI) which shows 60% of households

would have to borrow money or sell something if they had an unexpected $400

shortfall.

Financial institutions have historically been a primary

provider of liquidity services of smaller amounts to cover consumers with this

volatility. Fifteen years ago, when

checks were the primary transaction device, overdraft services helped consumers

manage cash flow and avoid fees from merchants or worse, a county attorney. However, in recent years the payment system

has changed dramatically with check volume falling, and where merchants,

PayPayl, digital lenders and others can offer consumers and businesses

liquidity immediately at point-of-sale.

For both regulatory and consumer preference reasons, overdraft services

are old “analog” technology for many consumers. A segment of up to 25% of bank customers using overdrafts, but another segment of 44% prefer other liquidity options and use alternatives to overdrafts as the segment chart below shows.

Liquidity services are still growing and in high

demand as studies like the J.P. Morgan Institution and the CFSI document.. Financial institutions unfortunately are only

providing liquidity services in the old “overdraft” model and have no service

in the new “digital liquidity” model.

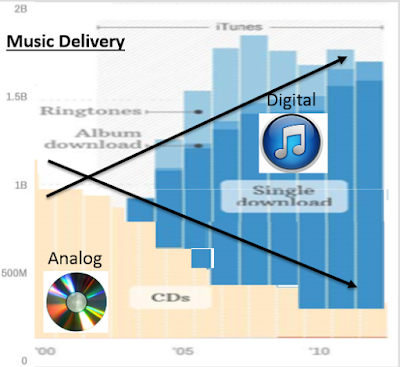

ODs are like CDs in the music business, which are falling in volume,

while total music sales are growing through digitally delivered song downloads.

"ODs" Are Like CDs While Digital Delivery is Booming

Financial institutions would be well-served to provide their

liquidity services with digital services to capture the growing market segment that is twice the size of overdraft services, in addition to providing overdraft services.

Such digital liquidity services do not cannibalize overdraft sales but

open a new channel and delivery revenue source that financial institutions are

losing today. Just ask our customers who

provide digital liquidity services like PaySmart and MinuteLender.

No comments:

Post a Comment