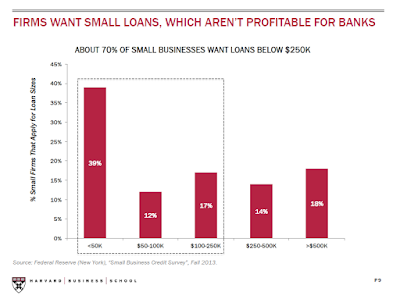

Community banks have over half of the loans to small

business according to FDIC data, but only about one-seventh of the business

loans under $100,000. In fact, community

banks, banks under $10B in assets, had more loans under $100k to small

businesses in 2006 than in 2016.

Digital lending, however, provides the technology to make

loans to this segment for under $200 a year, and with a great customer

experience in three minutes on a smart device.

For more information, download our Whitepaper, Digital Drives Segmented Small Business Lending

Strategy.

No comments:

Post a Comment