Banks over $1 Billion had to report overdraft and other

service charge fee income in detail for the first time for the first quarter of

2015. Two insights from the data are clear: 1) Service charge revenue is not growing, and 2) overdraft

fees came in at nearly half of all service charge revenue after adjusting

interchange fees to net revenue from gross.

Why are revenues not growing despite bank re-pricing accounts, and why are overdraft fees, a form of loan and liquidity, such a large

component of total deposit account “service charges”?

The answer is that the key need of consumers and revenue generator of transaction

services are loan and liquidity services, whether you are a bank, a retailer, a

company serving small businesses, or PayPal who says PayPal credit is the

centerpiece of their service. If you do

not make money providing liquidity services to support payment and transaction services, you

are like a restaurant providing food services and trying to make money without a liquor license and revenues.

Two independent studies have found the key need for

households is loan and liquidity services to handle as little as a $400 monthly

shortfall or variation in income. While

many in the financial services industry seek to grow service charge revenue by

adding fees to accounts, that revenue source is the smallest and the least

accepted by consumers. Yet, they are not offering alternatives for liquidity, the key revenue source, matched to today's payment system and technology.

The Key Need of Up to 60% of Households Is Monthly Liquidity

Wise bankers will see that liquidity services are what many

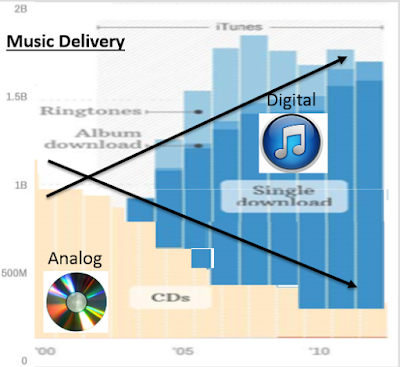

customers want and for which they are very willing to pay. Overdrafts, however, are today an old “analog” service delivery related to checks in a payments system

that has shifted to debit and electronic payments.

ODs are like music CDs in the music business, which are falling in volume,

while total music sales are growing through digitally delivered song downloads.

Financial

institutions would be well-served to provide their liquidity services with

digital services to capture the growing market segment that is twice the size

of overdraft services. Non bank digital competitors are booming.

Digital Small Loan Non Bank Competitors

Such

digital liquidity services do not cannibalize existing overdraft revenues but open a new

channel and delivery revenue source that financial institutions are losing

today. Just ask our customers who provide digital liquidity services like PaySound and Cashflow

Checking.

Hello,

ReplyDeleteHave you been struggling financially? Have you been trying to get a loan at low rate? Do you need the help of a private lender to help you get loan? Do you need loan to finance your estate or refinance your mortgage? Have you been planning to start a new business or expand an existing one? Are you a student that have been thinking hard for where you can get a student loan? We also render auto loan to trucking companies and truck drivers. Our services are also reachable to those who are business men and women. We offer all kinds of loan and we make it easy to transfer no matter the amount you need and your location. We offer all these loan services at a very cheap rate of 3%. Do not be afraid to apply because we offer loan in all currencies. We are reachable at jaafarlending44@gmail.com

If you are interested in the loan, you are to fill the following details to start the loan process.

Borrower's Information.

1. Full Names :...................

2. Address :...................

3. State :...................

4. Country :...................

5. Telephone :...................

6. Gender :...................

7. Marital Status :...................

8. Occupation :...................

9. Monthly Income :...................

10. Loan Amount Needed :...................

11. Loan Duration :...................

12. Loan Purpose :...................

13. Have you applied before? :...................

You are expected to apply with the correct details so that we will send you the loan terms and conditions.

Regards,

Jaafar.