Community

banks are looking for better ways to serve their customers and grow

revenues. Given that the easiest revenue

growth comes from serving existing customers using services elsewhere that the

bank can provide, the biggest opportunity for community banks is to serve their

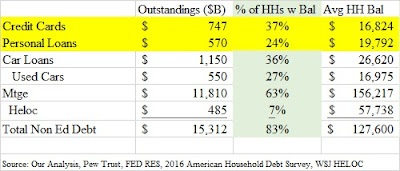

existing customers are using loan services elsewhere. This opportunity is in the credit card and

personal unsecured credit as shown below.

Community

banks historically could not efficiently serve this market, faces compliance

challenges and did not want to deal with the large number of declined

loans. Yet, the majority of their

customers have these loans but as a result not with the community bank. Digital lending provides efficient delivery,

compliance management and profitable risk-adjusted pricing for lines of credit

or installment loans linked directly to consumer checking accounts. Lean more

about the customer experience, efficiency and revenue digital lending can provide

your consumers and small businesses at www.rcgiltner.com.

No comments:

Post a Comment