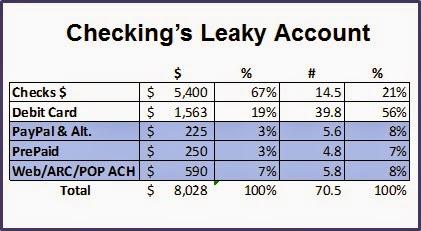

About one quarter of transactions settling to a bank account

today arrive not as a check or debit card transaction, but as a debit ACH item, as

the chart below shows. This is why checking revenues are not growing today despite account-based strategies like ending free checking, charging for statements and selling add-ons like identity theft or shopping discounts. In fact, revenues are going to even more quickly leak out of accounts bank's hold in the future.

Why? Because

consumers today are choosing at an increasing rate payment services not by comparing or using bank checking accounts, but non-bank payment

providers. These providers include PayPal, retail decoupled debit cards like Target’s Red Card

and Cumberland Farm’s gas card, prepaid cards and online biller payments using

bank account number and routing number. The

non-bank providers are offering payment features that are stealing the transaction upstream from the bank, settling as debit ACH, and stealing the revenue,

relationship value and payment relevance. The bank retains with all its costs, but has falling revenue.

What are the key features these non-bank payment services

are leveraging to steal transactions that banks are not?

Market research shows three key features where bank checking accounts

are missing the opportunity to win revenue:

- No overdraft fees ever. Walmart's Bluebird, American Express's Serve, GreenDot's GoBank, PayPal, and retail cards promote that a customer can be assured no overdraft fees ever. No bank, other than our clients, offering a checking account with no overdraft fees ever, including no return check fee charges.

- Access to affordable liquidity options. Need a few hundred dollars at a reasonable cost for a payment or retail purchase. PayPal offers BillMeLater. Retailers offer payment plans. Billers offer late payment options. Nearly all bank checking accounts offer no other liquidity option than overdraft fees.

- Online and in-store payment security. Target's Red Card use is up since its security breach with the security guarantees it offers. PayPal is initiating a major advertising campaign this summer highlight they "put the customer in control" and protect them with no card present online and now in-store. Prepaid cards offer the security of loading and partitioning specific funds.

No comments:

Post a Comment